FAQs

Find answers to frequently asked questions.

All Blaze ARM loans come with the Rate Re-Lock Guarantee which means you can re-lock your rate at any time, for an additional fixed period, at current rates. The available rate will depend on your original chosen loan program. The newly re-locked rate will be applied to the remaining term and principal balance of your existing Blaze ARM. Re-locking does not require an application, credit check or appraisal. Fee applies. To request a re-lock, please contact your Mortgage Loan Officer for details.

Escrow accounts hold funds for property taxes and insurance payments. Every year Blaze is required to analyze your escrow account to determine if we are collecting an adequate amount to pay your property tax bills and insurance premiums for the year. The purpose of the Escrow Account Disclosure Statement is to provide information on amounts collected and paid for the previous year and projected payments for the current year.

Generally, shortages are caused by an increase in property tax bills and/or insurance premiums. The amount collected in escrow is based on the prior year invoices so if the amounts increase for the current year, the funds collected could be short.

You have two options if you have a shortage:

- You can pay the shortage at least two weeks prior to your scheduled payment change date listed on your escrow analysis. Please note, if you choose this option, your monthly payment will be adjusted to not collect for the shortage amount.

- You can pay the shortage amount over the next 12 months with your monthly payment. No action is required for this option.

Escrow Surplus

Any surplus over $50 will automatically be deposited into your share savings account within 2 weeks of the escrow analysis statement date.

Updating Automatic Payments

If you have set up your automatic payment through Digital Banking or Bill Pay, then you will need to update your payment amount. If Blaze has set up your automatic payment for you, we will update this on your behalf.

If you are having financial hardship and are past due on your loan, please contact our Collections department at 651.215.3510. One of our representatives will help you with a solution.

Blaze also recommends LSS Financial Counseling, a certified nonprofit financial counseling service that has been providing free, nonjudgmental support and guidance for more than 35 years.

We are committed to helping you get your insurance claim check funds as soon as possible. To minimize delays in receiving your funds, please ensure the required documents are submitted and signed prior to visiting the branch.

Check is made payable to you, First Mortgage Company, and then Blaze Credit Union

Submit the following to Blaze Mortgage Servicing using our secure contact form:

- Copy of the Insurance Claim Check

- Declaration of Intent to Repair—signed by at least one borrower

A mortgage servicer will review and arrange for your check to be signed in a branch.

Check is made payable to you and Blaze Credit Union

Submit the following to Blaze Mortgage Servicing using our secure contact form:

- Copy of the Insurance Claim Check

- All pages of the adjusters’ report

- Declaration of Intent to Repair—signed by at least one borrower

A Mortgage Servicer will review your documents within three business days. When the review is complete, we will contact you with the next steps. The size of your claim will determine the level of monitoring required.

The easiest and most secure way to submit your payment is through Blaze Digital Banking. Select the Transfer & Pay menu to get started.

For additional options, please visit our Manage Your Blaze Loan.

Generally, property taxes and insurance premiums change yearly which would cause a change in your payment. If your property taxes and insurance increase, your payment will increase as well.

If you are requesting the payoff amount for your mortgage, please contact Blaze Mortgage. A Mortgage Servicer will provide you with the payoff amount within one business day.

If you are a title company or other third party representing a borrower, please contact Blaze Mortgage and attach the borrower's written authorization along with your request. A Mortgage Servicer will review your request and respond within one business day.

Page 1

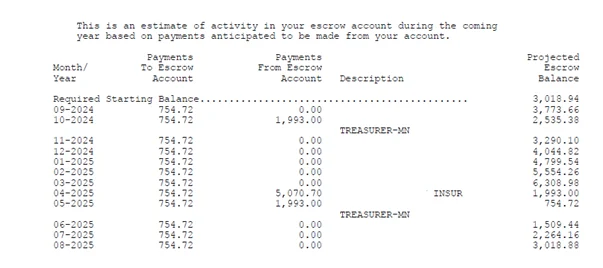

The first page of the Escrow Analysis provides the projections for the coming year effective September to August.

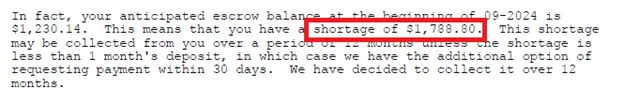

This paragraph will let you know if you have a shortage or a surplus.

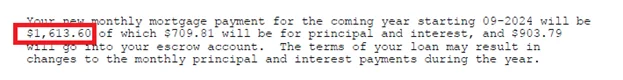

Your new monthly payment which includes the adjusted property tax and Insurance payments along with the shortage if it applies.

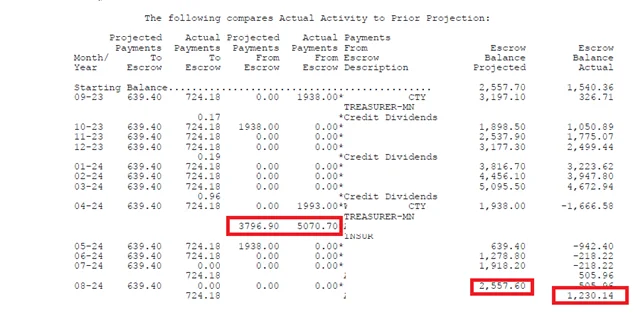

Page 2

This page compares the projected payments to the actual payments.

For this example, the main reason for the escrow shortage is because of the increased Insurance premium.

If you would like to pay your shortage listed on page 1, complete the form below no later than 2 weeks prior to the September 1st payment.

Blaze Credit Union will consider requests for subordination of equity loans after a thorough review. Requests will be processed upon receipt of a complete subordination package.

Required Items:

- Completed Subordination Request Form

- Copy of the member's signed authorization form

- Copy of the Underwriting and Transmittal Summary (1008)

- Copy of the signed Uniform Residential Loan Application (1003)

- Copy of the Loan Estimate or Closing Disclosure

- A complete copy of the appraisal. If not required for your loan, a copy of the Collateral Valuation (Fannie Mae/Freddie Mac) or AVM.

- A copy of the Title Commitment

- A check for $250 payable to Blaze Credit Union. Please include the Blaze Account Number and reference that the check is for a Subordination Agreement. The fee is non-refundable.

- Return Fed Ex, or UPS label and envelope

Send the required fee and all documentation to:

Blaze Credit Union

ATTN: Mortgage Servicing

2025 Larpenteur Ave W

Falcon Heights, MN 55113

Incomplete requests will not be processed until all items are received. Please allow 5 - 7 business days for processing from the date of receipt of complete package. If you have any questions or concerns, please call us at 651.215.3500.

- Once you've finalized your new insurance policy, make sure to cancel your homeowner's policy with your previous insurance provider.

- Your new insurance policy should include your loan number and this mortgagee cause:

Blaze Credit Union

ISAOA/ATIMA

PO Box 1999

Carmel, IN 46082

- If Blaze has paid an insurance premium on your behalf to the previous provider within the past 12 months, retain any refund you receive from the previous provider. You should then pay your new provider's premium out-of-pocket. It does not need to be deposited into your escrow account at Blaze.

- If you would like Blaze to make the new premium payment to your new insurance carrier, please contact Blaze Mortgage Servicing. Then, send a check in the amount of any refund you received from your previous carrier to be deposited into your escrow account payable to Blaze Credit Union.

- Any adjustments to your escrow account related to the cost of your homeowners insurance will be reflected on your next Annual Escrow Analysis in June.

Private Mortgage Insurance (PMI) is required on your loan if your Loan to Value ratio is more than 80%. PMI protects lenders and others against financial loss if the borrowers default. Charges for the insurance are added to your loan payments. Under certain circumstances, federal law gives you the right to cancel PMI or request PMI to automatically terminate.

If you are current on your loan payments, PMI will automatically terminate on the date the principal balance of your loan is first scheduled to reach 78% of the original value of the property.

If you would like to request the cancelation of PMI on your loan, please contact Blaze Mortgage Servicing for guidelines.