![]()

From new branches to innovative technologies, to enhanced service and a broader product portfolio, Blaze Credit Union is driven to continue bringing you more on our path to being Minnesota’s Best.

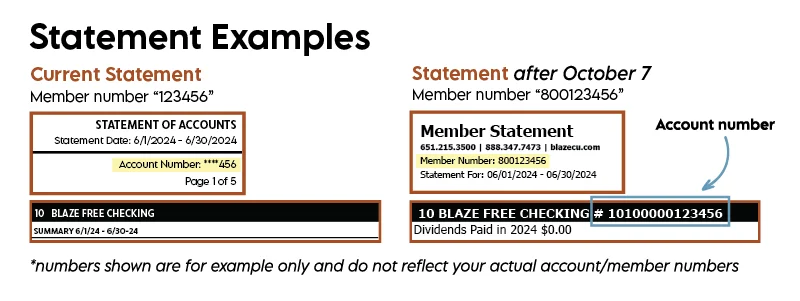

On October 7, 2024, we completed our conversion to a new, upgraded core system and digital banking platform to provide a solid foundation for future growth.

Important Dates & To-Dos

Many changes will take place behind the scenes, though there will be a few you’ll want to take notice.

Tuesday, October 8

Blaze branches reopen and legacy SPIRE members can log into their new digital banking experience and download the new Blaze Mobile app.

Wednesday, October 9

Credit and debit card management features and transaction information is expected to be available in digital banking.

*All dates & times in Central time

Recommended Actions

Legacy SPIRE Members:

- Review your scheduled Bill Pay and scheduled transfers before Thursday, October 3 to make sure they look correct in the new digital banking experience on October 8.

- Add account alerts in digital banking on October 8.

- Download the new Blaze Mobile app on October 8.

- If you use eBills, they will not be migrating to the new system. You will need to manually add them in digital banking on October 8.

Intuit, QuickBooks, and Quicken Users

This service will not be available from Friday, October 4 at 6:00 pm CDT through Monday, October 7 once digital banking access is restored. You will need to reconnect to these systems after the core upgrade is complete to ensure the smooth transition of your data.

Please select the appropriate guide for the product you are using from the options listed below. These conversion instructions reference two Action Dates. Please use the dates provided below as this information is time-sensitive:

1st Action Date: Friday, October 4 prior to 6:00 p.m. CDT

2nd Action Date: Monday, October 7 after digital banking access is restored

Conversion Instructions

Third-party Payment Apps

You will need to reconnect your digital banking credentials to apps like Venmo, PayPal, and NetGiver.

What is Changing?

Many changes will take place behind the scenes, though there will be a few you’ll notice.

What's Staying the Same?

Though you'll experience some changes, many things are staying the same.